In our previous Investment Glossary posts, we’ve focused on helping you understand the jargon behind return calculations. What is a maintenance rate? How is a vacancy rate calculated? Today we’re going to take a look at the other side of the investment equation: What happens when you sell a property?

Depreciation recapture is a tax provision that allows the IRS to collect taxes from the sale of a property that has been depreciated in the past. When you own a property, especially for business or investment purposes, you can deduct the costs of wear and tear, deterioration, or obsolescence of the property from your taxable income, which is called depreciation.

However, if you sell the property for more than its depreciated value (but not more than its original cost), the IRS requires you to “recapture” that benefit — meaning, you have to pay tax on the amount of depreciation you claimed. Essentially, it’s a way for the tax authorities to reclaim some of the tax benefits you received from depreciating the property.

While most people have at least a general understanding of capital gains taxes, there’s one component of your tax bill that many people struggle to comprehend: depreciation recapture. Not only is this concept crucial when determining the potential cost of selling a property – since depreciation recapture can be taxed at a whopping 25% – it’s also the first thing you should be looking at when calculating the taxes due on the sale of a property. In fact, an accurate capital gains tax calculation depends on accurate depreciation recapture figures.

Terms to Know

To understand this concept, you don’t need to get into the nitty-gritty of the IRS tax code. However, it is helpful to understand a few key terms:

Depreciation: The reduction in the value of an asset that occurs over time. If you own a property for more than one year, the IRS assumes it will be worth less and less every year because of wear and tear. The IRS specifies a ‘useful life’ of a certain number of years for each type of asset.

Example: Personal property, like computers or machinery, may have a useful life of 3, 5, 7, or 10+ years.

Depreciation Deduction: Each year, you get to take a tax deduction equal to a percentage of the original value of the asset for a set number of years, called the ‘recovery period’, typically equal to the useful life of the asset.

- Since the useful life of real property is 27.5 years, that’s how long you can take depreciation deductions on your annual tax return.

- The useful life and recovery period for each asset class depends on the depreciation method being used. Most people will use the General Depreciation System (GDS) unless they are either required or elect to use the Alternative Depreciation System (ADS). The recovery periods being referenced here are those outlined under the GDS method, since it is most common.

Recapture: The IRS gives you a tax deduction for depreciation every year that you hold a property based on the assumption that the value is declining. If you sell the property at a profit, the IRS wants to take back, or ‘recapture’, those deductions by taxing the amount of your total gain attributable to depreciation.

- Gain from depreciation is taxed at your ordinary income tax rate, up to a maximum rate of 25%

Section 1250: The section of the IRS tax code that outlines how any gain on the sale of real property due to depreciation should be taxed. When you see people referring to ‘Section 1250 recapture’, that’s depreciation recapture.

Adjusted Basis: The tax basis of your property after accounting for improvements you’ve made to the property, fees and expenses incurred in the purchase and sale of the property (like commissions and escrow fees), and depreciation.

Gain: The difference between your property’s adjusted basis and the price you sell it for. If the sale price is more than the adjusted basis, you have gain. If it is less, you have a loss.

Capital Gain: The portion of your total gain that is not attributable to depreciation.

- If you hold a property for more than one year – like you would a traditional turn-key investment – this gain is taxed at a lower long-term rate of up to 20%, depending on your ordinary income tax bracket.

Putting It All Together

OK, now that you’ve got the jargon down, let’s get to the math. The purpose here is simply to help you understand what depreciation recapture is and how it works, so we’re going to use pretty nice round numbers and a very simplified scenario. In reality, these calculations typically require the assistance of a qualified tax professional – the tax code is a detailed and convoluted mess of legalese, so don’t skimp on getting solid professional help come tax time.

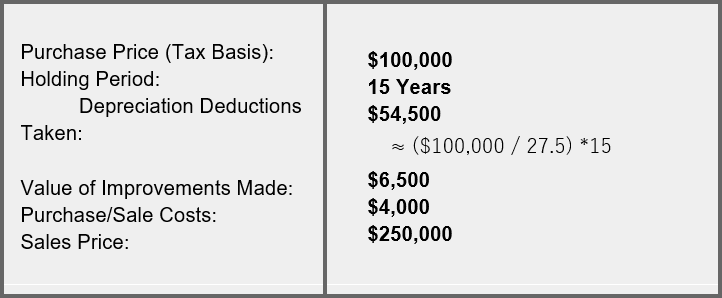

For the purposes of our example, assume the following about the property being sold:

From this data we can calculate the following:

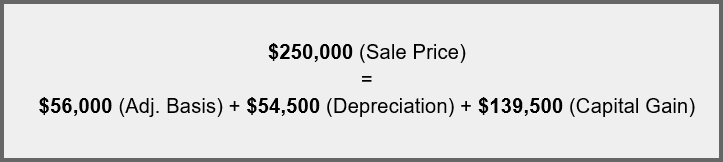

Let’s double check that math. The sales price should be equal to the adjusted tax basis, plus the depreciation gain, plus the capital gain.

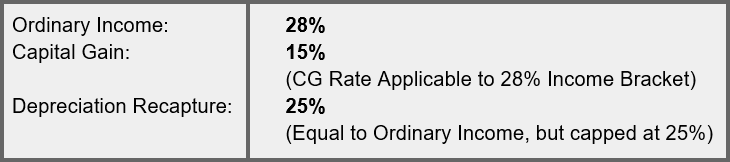

Looks like it all checks out. So now, based on these figures we can easily calculate the total tax that would be due on this sale. Of course, it will depend largely on your marginal tax rate. For the purposes of this example, let’s assume you’re in the 28% bracket. Since you’ve held the property for more than a year, your capital gains are considered ‘long-term’, so your tax rates will look like this:

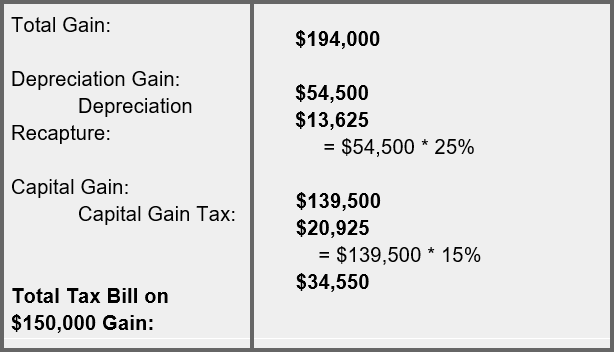

The taxes due on the sale of your appreciated property look like this:

The Take-Away

As you can see, even if you manage to lock in 150% appreciation over the course of your investment, the tax bill you’ll rack up when you sell can be pretty hefty. This is one of the primary reasons many investors turn to the 1031 exchange process. By selling your appreciated property within an exchange (with the help of a reputable Qualified Intermediary, of course) you can defer taxation. Instead of paying $34,000+ in taxes on the sale of this successful investment, you could roll the entire $250,000 value into another investment property (or multiple properties). Those would-be tax dollars keep working for you and Uncle Sam gets nothing.

If you’d like to learn more about the power of the 1031 exchange, check out our six-part series, [The Tax Man Cometh: Deferring Taxation With A 1031 Exchange].

Remember:

- Take your depreciation deductions!! There is no benefit to not taking your deductions. When you sell your property, the tax basis will be adjusted as if you took them. The IRS doesn’t care if you actually take your depreciation deductions or not.

- For property ‘placed in service’ after 1986, the IRS uses the Modified Accelerated Cost Recovery System (MACRS) (which is comprised of the GDS and ADS methods referenced earlier) to determine the asset life and recovery period for depreciable property. If you own property that has been used as a rental investment since before 1986, make sure to speak to your CPA about what that means for your taxes.

- There are a few different methods you can use to calculate depreciation, some resulting in an accelerated deduction schedule (you take larger deductions in the early years of ownership). Speak to your CPA about which depreciation schedule makes the most sense for you.

- Investment taxation is almost never straightforward. Make sure you have a qualified, fiduciary, tax professional on your team.

Till Next Time…

While turn-key rentals are meant to be a long-term investment – something you hold for 10 years or more – even long-term investment properties eventually get sold. And that’s when your taxes can get pretty complicated. We hope this Glossary installment has helped you better understand the complicated issue of depreciation recapture and how it could impact your exit strategy.

If you have any questions, want to learn more about the Birmingham turn-key market, or are interested in what we do here at Spartan, feel free to get in touch any time.