Ever since the dawn of the COVID-19 pandemic, the U.S. real estate market has been on a tear. In the twelve months between August 2020 and August 2021, American home prices rose by a national average of 19.8%—the highest annual increase ever recorded.

But this national uptick in housing prices has hardly affected every place in the Union equally. Some metro areas, already infamous for their sky-high costs of living, have only grown more unaffordable.

For example, in Bellevue, Washington—a bustling Seattle suburb home to nearly 150,000 people—home prices soared by an eye-watering 45.6% in the last two years alone. The median home, which cost an already-sizable $887,500 in the third quarter of 2019, skyrocketed to just shy of $1.3 million in July 2021.

Likewise, in San Jose, California—a Bay Area city known for being both the epicenter of Silicon Valley and for being one of the least-affordable cities in the country—housing prices exploded by over 30% during the previous two years. Today, the median home in the balmy West Coast city sells for $1.4 million, a figure that would take a whopping $240,000+ annual salary to afford.

Suffice to say, the housing market is blazing hot—and in some areas, far too hot to touch. Put another way, it’s likely best that you keep your distance from these locations.

But if Seattle or San Jose doesn’t fit the bill, where in the country should you invest? While you have many choices, perhaps it’d be wise to recall NHL star Wayne Gretsky’s sage advice to “skate to where the puck is going, not where it has been”.

Translation? Your best bet as a real estate investor is likely on up-and-coming yet under-the-radar markets—soon-to-be boomtowns for you to plant your flag before the rest of the country rushes in and starts bidding property values up. Luckily for you, there’s a large (and often overlooked) swath of the United States that fits the bill.

Welcome to the Deep South

The American South may not be the first region to come to mind when you think about economic growth and prosperity—but don’t be so quick to dismiss this part of the country. If you thought the South was home to little more than yeoman farmers and tiny, dilapidated towns, you’d be forgiven—but also sorely mistaken.

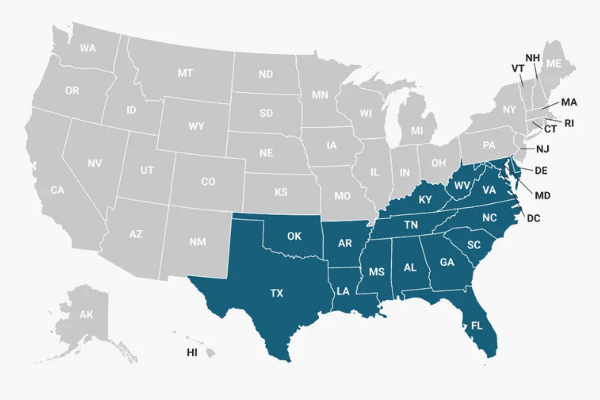

Comprising five states—Louisiana, Mississippi, Alabama, Georgia, and South Carolina—in addition to parts of Arkansas, Tennessee, and North Carolina—the rapidly-growing Deep South is home to more than 30 million people and counting.

The region’s population influx has been due to a combination of factors—not the least of which is the “Second Great MIgration”. A reversal of the original Great MIgration in the early to mid-20th century, this emerging trend has seen younger Americans leave large, crowded, and increasingly unaffordable Northern and coastal population centers like Los Angeles, Chicago, New York, or Philadelphia—and opt to settle in Southern metro areas instead.

As a result, the Southeastern United States is expanding at a fast clip. In the past ten years, large cities in the region like Nashville and Atlanta have both grown at double-digit rates—causing real estate markets in the area to pick up speed. The state of Georgia, for instance, gained 53,000 housing units in 2018, the fifth-highest of any state in the country.

But big cities aren’t the only beneficiaries of this population boom. In fact, smaller metro areas have grown even more quickly. In the past decade, Murfreesboro and Franklin—both in Tennessee—ballooned 34.6% and 32.8%, respectively, becoming two out of the top ten fastest-growing cities in the United States. Mount Pleasant—a picturesque Charleston, South Carolina suburb currently home to under 100,000 people—also made the top 10 list, growing by an impressive 34.1%.

What’s to like about the South?

Between rising costs of living and declining quality of life, it’s clear to see why young Americans and the Millennial crowd at large are eschewing coastal hubs. But why are they drawn to the South in particular?

There are at least a few selling points. On the surface, the climate is arguably more hospitable. In exchange for slightly hotter and drier summers, residents of the Southeast are spared the harsh winters and disruptive snowfalls that burden their compatriots up in the Midwest and New England.

The Southeast’s desirability can also be linked to more important structural reasons as well. For starters, housing is extremely affordable. With a median home price of just $134,125, Mississippi is the second-cheapest state to buy a home in, behind only West Virginia.

Arkansas, which boasts a median home value of $142,070, is similarly budget-friendly. So is Alabama, which ranks as the fifth-cheapest state in the country to live in. The Yellowhammer state sports a median home price of just $158,809—making housing in the heart of the Deep South over 85% more affordable than some of the priciest cities in the Union (looking at you, San Jose).

Is the South’s affordability good value—or a value trap?

However, not all forms of affordability are created equal. While housing markets in some vibrant locations provide good value, other floundering cities feature low-cost housing only because they are well past their prime—or possibility even in terminal decline.

As a case in point, cities like Hartford, CT, Wilmington, DE, or Baltimore, MD are all affordable, no doubt. For example, the median home value in Baltimore is just over $200,000—not too far removed from the cost of housing in a state like Alabama.

But the similarities basically end there. In fact, a closer look at these two locations reveal stark underlying differences. Hartford, once proudly called the “Insurance Capital of the World”, now struggles with a 28.0% poverty rate, one of the highest in the country.

Corporate giants, like Aetna and General Electric—the former of which was even founded in Hartford back in 1863—have left the city in droves, citing suffocating tax rates and a hostile regulatory environment.

Wilmington, DE, is likewise facing decline. The city’s median income has been falling for the past several years, a consequence due in part to the exodus of many large employers. Chemicals company DuPont left the area in 2015, taking with it over 1,000 jobs. As a result, Wilmington has faced an increase in child poverty rates and other associated gauges of misery—despite a fall in the national average.

As a result, these three cities’ real estate markets have never recovered from the Great Financial Crisis, ranking among the worst-performing areas since the Recession.

The South’s upcoming renaissance

In contrast, Southern states could hardly be in a more different position. For starters, Alabama is one of the most tax-friendly states in America. It combines a modest sales tax rate of just 4% with an equally-low state income tax rate that tops out at just 5%.

In addition, the state’s property tax rates are the second-lowest in the country, behind only Hawaii. Of course, these are only in percentage terms. Combine a median home value in the mid-$100,000s with a median property tax rate of just over 0.3%—and you’re effectively left with the lowest real estate tax rates in the entire country in dollar terms.

For instance, in Jefferson Country—home to Birmingham, the state’s most populous city—homeowners pay an average of just $857 a year in property taxes. In neighboring Tuscaloosa County—home to a city of 90,000 with the same name—residents’ pay just over half as much, or $493 per year. Similarly, in Madison County, where Huntsville is located, homeowners can expect to owe just $709.

A business-friendly environment

This rare combination of modest home values and light property tax burdens make Alabama an enticing option for both businesses and individuals considering a move. In particular, businesses see the state’s affordable real estate acquisition and carrying costs as an opportunity to establish and maintain a strong physical presence in the city.

For instance, J.M. Smucker Company announced that it would construct a $1.1 billion-dollar manufacturing facility in Birmingham, a venture that would create 750 jobs in the area. Other household names, like FedEx and SiO2 Materials Science, are also planning eight and nine-figure real estate projects in the region.

This torrent of physical and human capital investment has spawned thousands of new high-paying positions with blue-chip companies—a boon to workers that has swiftly propelled the state’s median income upward. From a pre-Crisis peak of just under $45,000, Alabama today touts a statewide median income of nearly $55,000—a figure that has shown great resilience to negative shocks like the COVID-19 pandemic.

This welcome development can be partially attributed to the state’s well-diversified economy. For example, the Yellowhammer state’s largest sector—the trade, transportation, and utilities industries—is host to 373,000 jobs.

This is equivalent to just over 19% of the state’s 1.94 million total jobs—a proportion that is healthily counterbalanced by the manufacturing sector’s 273,000 jobs (13.5% of total positions), the education and health services sector’s 231,000 roles (11.9%), and the professional and business services sector’s 240,000 positions (12.3%).

Meanwhile, across all industries, Alabama’s weekly wage is $858. Assuming 4.25 weeks per month, that’s $3,647 in monthly earnings, more than enough to cover the cost of the state’s $998 median monthly rental price—which is estimated to require a $3,326 monthly income to afford.

In short, this means a healthy and ever-growing pool of renters who have both the appetite and the means to afford a wide range of accommodations—a set of circumstances that represent strong tailwinds for current and prospective residents in the region. Combine this with a friendly tax regime, a growing population base, and a burgeoning property market—and Alabama may very well be the next go-to destination for real estate investors and developers as well. Maybe that’ll even include yourself!

Let Spartan Invest partner with you

With a 60-person-strong, Alabama team of real estate professionals—including leasing agents, construction supervisors, market operators, property managers, and more—we know our markets like the back of our hands.

We have extensive experience acquiring, building, rehabilitating, leasing, and managing real estate in the Birmingham, Tuscaloosa, and Huntsville areas. We’re also in parts of North Georgia and Chattanooga, Tennessee.

We’d love to share our expertise with you and can’t wait to see how we can work together to earn you market-beating returns in the Magic City and beyond!