Of all many real estate boom-and-bust cycles in living memory, none have arguably been as dramatic and significant as the 2008 Global Financial Crisis. Triggered by the collapse of the subprime mortgage market, the housing bubble’s implosion in the late aughts led to widespread loan defaults and property foreclosures that dragged nationwide home prices down 27.4% over six years.

Today’s economic worries are different from those the country faced in 2008. This decade’s primary concerns are sticky inflation and waning affordability rather than recklessly loose lending conditions.

In particular, inflation has remained stubbornly above the Federal Reserve’s 2% target, with consumer prices rising by a stronger-than-expected 3.5% in March 2024 year-over-year, up from 3.2% in February. This uptick in annualized inflation, coupled with March’s robust jobs report, has heightened worries that the Federal Reserve won’t cut its benchmark interest rate anytime soon from its 23-year high of 5.25–5.5%.

These high interest rates have, in turn, sharply eroded housing affordability. Today’s housing market is “the most unaffordable…in recent memory,” with Fortune magazine remarking that it is now cheaper to rent than buy in every one of the top 50 metropolitan areas in the country.

Although it is difficult to make macroeconomic forecasts with great certainty, this potent mix of high inflation, rising interest rates, and climbing property prices may signal that further market turbulence—or even a downturn—could be on the horizon.

A look back at 2008

Economic downturns are periods of contracting economic activity characterized by declines in measures like the gross domestic product (GDP), employment, industrial production, and household incomes. Severe downturns are termed recessions, traditionally defined as two consecutive quarters of negative GDP growth.

However, downturns can manifest in different ways—ranging from mild slowdowns and protracted recessions to full-blown financial crises marked by market volatility, credit crunches, asset valuations, and system-wide liquidity shocks.

In the years leading up to the 2008 financial crisis, low interest rates and easy access to mortgage credit fueled a speculative frenzy that saw home prices increase by an average of nearly 50% between 2003 and 2006. In a bid to capitalize off the https://spartaninvest.com/real-estate-investment-calculator/ he surging national appetite for real estate, lenders became increasingly lax, allowing borrowers with poor credit to obtain loans they couldn’t afford. Worse, these so-called “no income, no job, and no asset” (NINJA) loans were often originated as adjustable-rate mortgages that featured enticing teaser rates that disguised the true cost of borrowing.

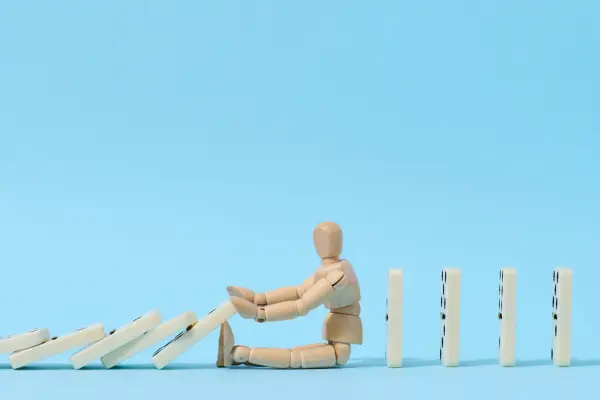

Quickly, a vicious cycle emerged. Lenders repackaged these risky loans into complex mortgage-backed securities and sold them to investors, promising that these bundled securities were less risky and better diversified than their unpacked counterparts. However, as the Federal Reserve began raising interest rates, monthly payments reset higher on a wave of adjustable mortgages. As the turmoil spread, home prices plummeted, and millions of Americans were left with underwater mortgages they could not afford. Soon, foreclosures swept the nation, and major financial institutions, such as Lehman Brothers and Bear Stearns, collapsed.

The ripple effects of this crisis spread across the global economy and sparked the Great Recession. The U.S. housing market, meanwhile, took more than a decade to recover, and it was not until January 2017 that home prices eclipsed the high recorded in July 2006.

Thankfully, 2024’s housing market is tamer than the environment faced by property investors during the financial crisis. For starters, the U.S. economy managed to avoid a recession in the previous year, and lending standards—at least for housing—are stricter than before. Still, lessons and parallels from the subprime mortgage crisis and the fallout it caused remain relevant today and can serve this era’s real estate investors well.

Rising interest rates

One notable similarity to 2008 is the sharp rise in mortgage rates over the past few years. The 30-year fixed mortgage rate skyrocketed from an all-time low of just 2.65% in January 2021 to a two-decade high of nearly 8% in October 2023 as the Federal Reserve aggressively hiked rates 11 times to combat inflation.

While rates have moderated somewhat, hovering in the 6.6–6.9% range in early 2024, they crossed the 7% threshold in the week ending April 18th, 2024. This spike mirrors the 2004-2006 period when the Fed raised its benchmark rate 17 consecutive times, which caused adjustable-rate mortgages to reset significantly higher over that span.

Affordability constraints

Doubling mortgage rates and still-elevated home prices have severely tanked housing affordability. Despite some deceleration, the median U.S. home sale price rose 5% year-over-year in the four weeks ending April 14th to $380,250. This figure is $3,095 below the record high of $383,345 set in June 2022.

According to a Redfin analysis, the last time the average household earned enough to afford the median home was in February 2021. Now, prospective buyers need an annual income of $113,520 to afford a typical house in the U.S., which is 35% more than the current median household income of $84,072. Though not identical, today’s situation is similar to the home value run-up between 2003 and 2006. Only then, loose credit and low down payments made homeownership appear as though it was more affordable than it was.

Home price appreciation is slowing.

While home prices soared at an annualized rate of nearly 20% between April 2020 and late 2021, the breakneck pace of appreciation has slowed dramatically. Data from Redfin shows that home prices in March 2024 grew just 0.6% from the previous month and 7.3% year-over-year. This stalling momentum harkens back to 2006 and 2007, when home prices first lost steam before ultimately turning deeply negative as the subprime crisis unfolded.

Building resilience: Strategies for property investors

Economic downturns are a natural part of the real estate cycle. Rather than an event to be feared, property investors should seek to navigate these challenges successfully and cultivate resilience by learning from past crises, implementing risk mitigation strategies, and adopting adaptable investment approaches.

Maintain ample liquidity reserves.

Sizable cash reserves of 6 to 12 months offer property investors operational continuity during downturns. Reserves act as a financial buffer and can help cover unexpected repairs, rental income gaps, or refinancing disruptions. This cushion can buy investors time to ward off foreclosure or a distressed sale.

On the other hand, property values frequently decline during downturns, and distressed assets may become available at attractive prices. Liquid reserves empower property investors to capitalize on these opportunities without relying on external financing, which can be challenging to secure during market stress.

Diversify across markets and asset types.

A diversified portfolio is a hedge against localized economic slumps or market bubbles. Spreading investments across various markets, regions, and property types allows income from thriving investments to offset potential losses elsewhere. Investors can also explore alternatives like Real Estate Investment Trusts (REITs), which are publicly traded companies that offer investors exposure to a diversified pool of real estate assets without direct ownership responsibilities.

Manage debt wisely

Investors who effectively manage debt can mitigate the risk of default, even if interest rates rise and rents decline. Fixed-rate mortgages are a conservative choice since they feature consistent monthly payments over the loan’s lifetime.

On the other hand, adjustable-rate mortgages (ARMs) offer lower initial interest rates, which can be advantageous when rates are expected to remain steady or decrease. However, when interest rates rise, ARMs may result in higher monthly payments—a particularly unwelcome problem in a downturn when rents are depressed.

On that note, investors should avoid overleveraging and maintain conservative debt service coverage ratios. This ensures that a property’s debt remains serviceable even if rents (and thus net operating income) decline considerably.

Focus on the long-term

Economic downturns are cyclical. While property values might dip temporarily, real estate generally experiences long-term growth. Holding onto properties for the long term allows investors to ride out temporary market fluctuations and benefit from eventual appreciation. Historically, residential properties have returned over 10% annually, reinforcing the idea that time in the market beats timing the market. A long-term hold strategy also helps investors avoid panic selling during downturns, a common psychological pitfall.