2023 has been an eventful and impactful year in financial life—one that has sent shockwaves of uncertainty across the U.S. economy.

Perhaps at the top of prospective homebuyers and investors’ minds are interest rates. After peaking at 7.08% in November 2022, the 30-year fixed rate plummeted to 6.09% in February 2023. Throughout March, April, and early May of this year, rates fluctuated within the 6% range before gradually rising again.

In March 2023, bank collapses captured headlines and disrupted the financial industry, adding to the economic turbulence. Meanwhile, the Federal Housing Finance Agency (FHFA) implemented new rules on low-level pricing adjustments (LLPAs) beginning May 1st, 2023, introducing additional complexities into the conventional mortgage lending space.

While the nation’s economy remains resilient, uncertainty surrounds the debt ceiling, which surpassed the $31.4 trillion limit in January. On the brighter side, overall inflation eased for the 10th consecutive month in April 2023.

As we approach mid-year, the big question remains: what are the implications of these macroeconomic events to markets? And where are we headed?

Key macroeconomic events shaping 2023

Interest rates

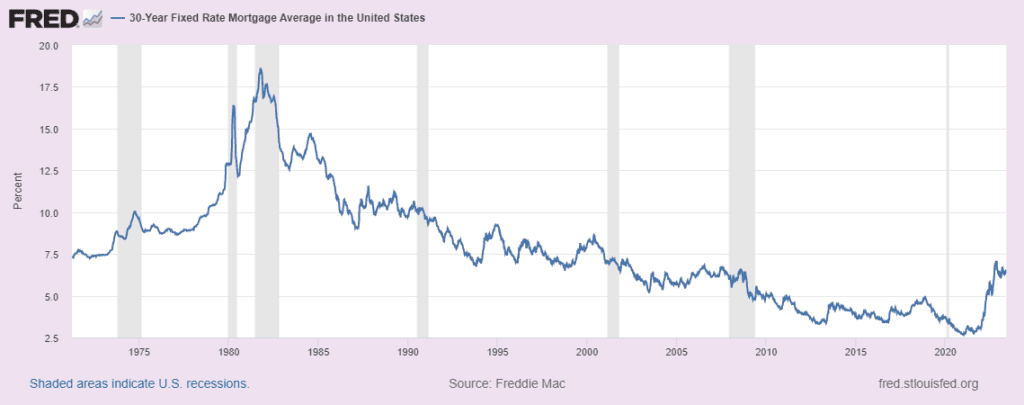

First, some context from last year. In brief, the average 30-year fixed-rate mortgage started 2022 out at a modest 3.22%, then surged to a staggering 7.08% in November 2022, partly due to the Federal Reserve’s ongoing series of aggressive rate hikes, which it initiated in March 2022.

As we entered 2023, the volatility in mortgage rates continued. The 30-year mortgage hit a low of 6.09% on February 1st, 2023, then peaked at 6.73% on March 8th, 2023, before stabilizing in the low to mid-6% range between April and mid-May.

In early May, the Federal Reserve implemented its 10th consecutive rate increase, raising the federal funds rate to over 5%—the highest level in 16 years. Coupled with the debt ceiling concerns, the move pushed the 30-year fixed mortgage rate from 6.39% on May 18th to 6.57% on May 25th, posing further housing affordability challenges.

Nevertheless, current mortgage rates remain relatively low compared to historical levels—especially those experienced in the ‘70s and ‘80s.

Inflation

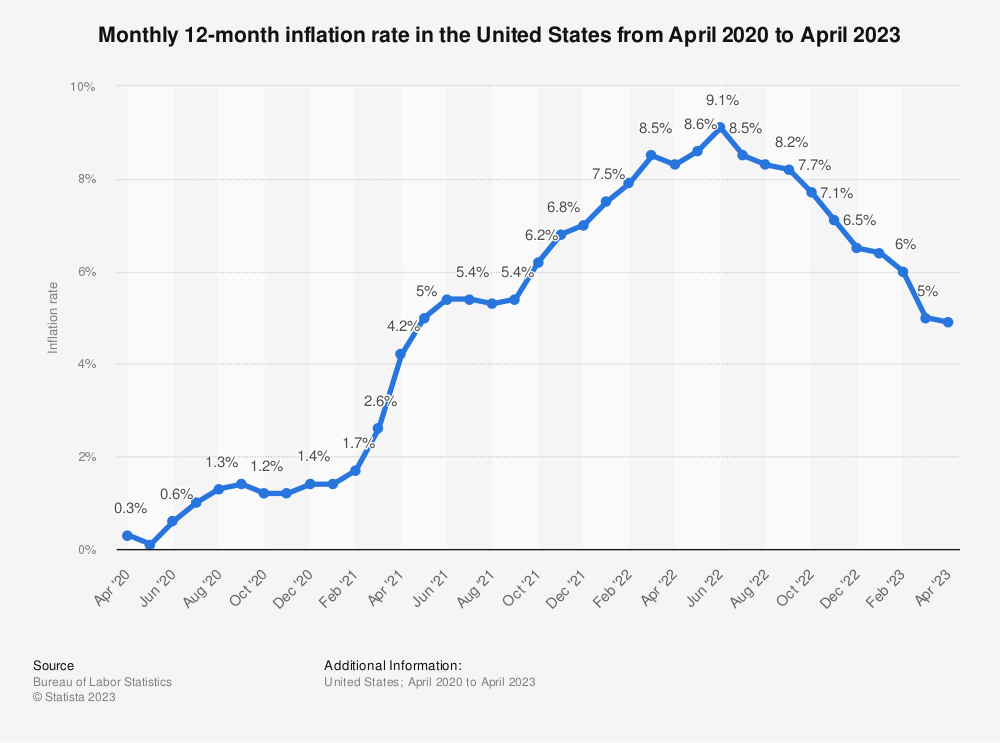

Inflation emerged as a significant concern in early 2021, reaching a 40-year high of 9.1% in June 2022. However, the Federal Reserve’s measures to curb inflation have shown signs of progress in 2023. For the past ten consecutive months, inflation has been on a downward trajectory, putting a damper on both rising housing prices and asking rents across the country.

The April 2023 Consumer Price Index (CPI) report by the U.S. Bureau of Labor Statistics indicated a 0.4% month-over-month increase and a year-over-year increase of 4.9%, falling below 5% for the first time in two years. Core inflation, however, remained stubbornly high—increasing by 5.5% over the past year. Despite this recent drop-off, the inflation rate remains above the Federal Reserve’s target range of 2%.

Bank collapses

March 2023 witnessed two of the largest bank failures since the Washington Mutual Bank collapse in 2008. Silicon Valley Bank (SVB), once the 16th largest bank in the U.S.—with approximately $209 billion in assets—was shuttered by the Federal Deposit Insurance Corporation (FDIC) on March 10th, 2023, following a massive withdrawal of over $42 billion by customers in one day. The bank, long a darling among Silicon Valley’s close-knit circles of investors and entrepreneurs, met its demise as the second-largest bank failure in American history

Two days later, Signature Bank, with assets worth $110.4 billion, met a similar fate as single-day withdrawals exceeded $10 billion. The New York City-headquartered bank became the third-largest bank failure in history, placing behind Washington Mutual and SVB.

Then, on May 1st, 2023, U.S. regulators seized First Republic Bank. With assets totaling over $212 billion, the bank overtook SVB for the number-two spot in bank failure history. All of the deposits and “substantially all” the assets of the high-net-worth-centric financial institution was subsequently auctioned off and sold to JPMorgan Chase, the country’s largest bank.

The series of bank failures saw the 10-year treasury yield drop by more than 15 basis points in March. The collapses are expected to have far-reaching effects on the housing market, including a decline in construction activity, and a tightening of credit availability.

Low level pricing adjustments (LLPAs)

On May 1st, 2023, the Federal Housing Finance Agency (FHFA) implemented changes to the fee structure for loan-level pricing adjustments (LLPAs). These adjustments directly impact the cost of conventional loans, taking into account factors such as credit score, loan type, and loan-to-value ratio.

The recalibration of the fee structure aims to strike a balance between housing affordability and individual credit profiles by aligning fees with borrower risk. Interestingly, these LLPAs could be a boon for subprime borrowers—a segment of the market that often puts up lower down payments and has lower credit scores than borrowers with stronger credit profiles. On the other hand, prime and super-prime borrowers—those with higher credit scores who can afford larger down payments—may face slightly higher fees.

For instance, a low-risk borrower with a credit score between 760 and 779 with a 15% to 20% down payment will have an LLPA of 0.625% (compared to 0.250% under the old structure). In contrast, a high-risk borrower with a credit score between 640 and 659 and a 15% to 20% down payment will have an LLPA of 2.250%—0.5 percent points below the previous fee of 2.750%.

Debt ceiling

On January 29th, 2023, the U.S. reached its debt ceiling, prompting the Treasury Department to take extraordinary measures to avoid default. The debt ceiling is a “soft” limit—Congress’ self-imposed limit that caps the government’s borrowing capacity. Since then, leaders from both sides of the aisle have been in a stalemate over raising the government’s $31.4 trillion debt ceiling.

The approaching deadline, potentially as early as June 1st, raises the risk of the nation running out of funds and failing to fulfill its obligations, including debts to bondholders and essential expenditures such as Social Security. The debt ceiling standoff has seen short-term Treasury bill yields rise to over 7%.

Where are we headed?

After the Federal Reserve’s May 2023 meeting, there was initial optimism about a potential pause in rate hikes.

However, economic data in April came in stronger than expected. Specifically, retail spending rose by 1.6% on an annualized basis in April 2023, indicating active consumer spending. Jobless claims also remained lower than expected, suggesting a tight labor market.

These positive indicators point to a healthy economy with limited signs of stress or impending slowdown, providing the Federal Reserve with the flexibility to tighten monetary policy to further curb inflation.

Following the provisional debt ceiling agreement on May 27th, 2023, the 10-year treasury bond yield fell 12.3 basis points as markets priced in a 59.6% probability of the Fed raising its policy interest rates.

Moreover, if May’s upcoming economic data continues to provide evidence in favor of a robust economy, the Fed may implement another rate increase in June, potentially leading to higher interest rates in the foreseeable future.