Mortgage interest rates in Q4 2022 and beyond

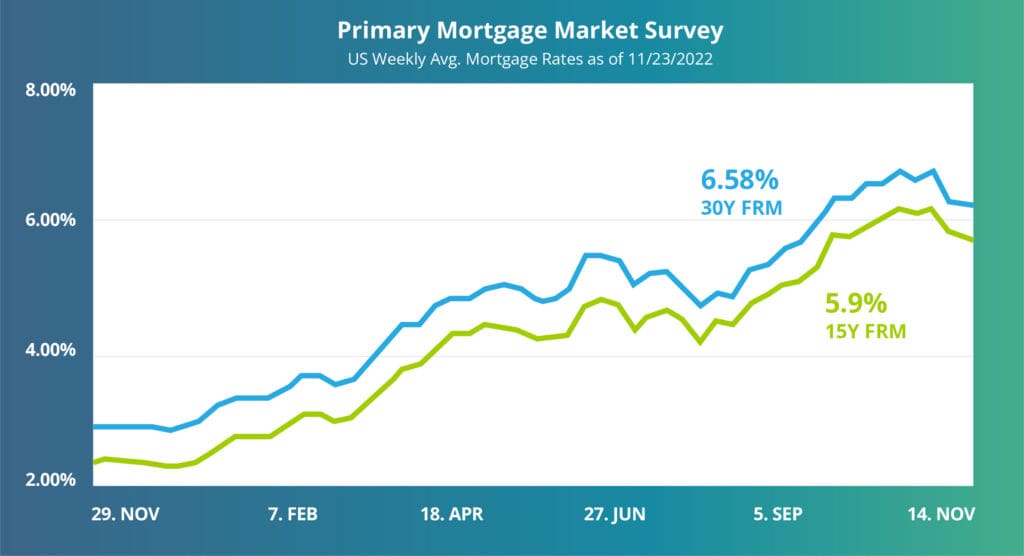

In the five months since data for this article were collected, rates have moved considerably. In the final week of June 2022, the 30-year fixed-rate mortgage hovered at roughly 5.7%.

Rates declined modestly in the following five weeks. By the first week of August 2022, the 30-year mortgage rate had fallen to just under 5%—a peak-to-trough drawdown of about 0.7 percentage points.

However, interest rates soared in the subsequent 12 weeks, rising by over two percentage points to notch 7.08% in the last week of October 2022. This marks a 20-year high—rivaling rates not seen since the first quarter of 2002.

In the four weeks since, mortgage rates have fallen once again. The most recent data for the week ending Wednesday, November 23rd, 2022 show 30-year rates at 6.58%—half a percentage point below the October high.

Several signs suggest that this slow drop in mortgage rates may persist into 2023. For starters, inflation expectations are declining, with consumers expecting prices to rise by just 2.9% in 2023—a stark contrast to the 7.7% surge between October 2021 and 2022.

As a result, the Federal Reserve has signaled that it would ease the pressure on interest rate hikes going forward. While the nation’s central bank is unlikely to lower rates anytime soon, it is expected to raise rates at a slower pace than before. Federal Reserve chair Jerome Powell has signaled that he would be receptive towards a smaller, 50 basis point rate hike in December 2022, followed by even less aggressive quarter-point rate increases in 2023.

For prospective borrowers and homebuyers, this is a welcome sign of things to come. A cooling property market coupled with a decline in mortgage rates means more affordable housing, smaller monthly payments, and lower lifetime interest burdens.

Editor’s Note: This article was written early in Q3 2022.

It may seem like a lifetime ago, but it was only in January 2021 that we had the lowest interest rates in history, with the 30-year fixed-rate mortgage sitting at just 2.65%. This was due in part to the Federal Reserve, which dropped the federal funds rate to 0%–0.25% in March 2020 after lockdowns were imposed in the United States in response to the pandemic.

But as the economy rebounds and inflation rates soar to 40-year highs in 2022, mortgage rates have steadily ticked up, with 30-year fixed-rate mortgages reach above 6% during the fall season of 2022.

This may sound alarming to consumers and real estate investors alike. After all, rates have increased significantly from the record lows experienced in 2020 and 2021. But the current interest rate environment also isn’t anything out of the ordinary, and some longer-term context may provide some comfort here. For example, the last time mortgage rates were as elevated as they are now was during the Global Financial Crisis in 2008, just a little over a dozen years ago.

Either way, rising rates are only one of many factors to consider when making the decision to invest, and considerations like your financial goals might be just as important—or even more important—than macroeconomic forces like interest rates and monetary policy.

Focusing on the long-term may also be helpful. After all, elevated rates are a short-term phenomenon—one of little consequence to real estate investors who are willing to be patient, sit tight, and wait for cash flows to stabilize over the long haul. Most importantly, real estate remains a dependable asset class, rate environment notwithstanding.

On that note, let’s take a closer look at interest rates—including where they’ve been in the past, where they might be heading next, and what you can do as an investor.

A brief history of mortgage rates

According to Freddie Mac’s historical mortgage data, which provides a history of mortgage interest rates dating back to 1971, mortgage rates have historically been high—far higher than they are now, in fact. In the early 1970s, rates sat at around 7.3%. By the end of the decade, a combination of policy errors, overseas wars, and double-digit inflation pushed mortgage interest rates to 12.9%.

For borrowers in this era, there would be more pain to come. The beginning of the 1980s saw the highest interest rates ever recorded when mortgage rates hit 18.45% in October 1981. The latter half of the decade provided some relief, but rates remained high, notching close to 10% by the end of the decade.

As inflation slowly cooled, mortgage rates declined as well. In the 1990s, mortgage rates hovered between 7% and 9%. It wasn’t until the early 2000s that rates finally declined to levels on par with what we see today. Rates continued to fall steadily throughout the 2010s, reaching a decade low of 3.35% in May 2013. The nation rounded out the decade near those lows, hitting an average rate of 3.94% in 2019.

The first two years of the 2020s were a rollercoaster for homebuyers. Rates began the decade at historical lows. Then, the pandemic hit. Thanks in some measure to the Federal Reserve’s efforts to stabilize the economy, rates fell even further, and by December 2020, the 30-year mortgage rate had plunged to 2.68%. Rates remained low in 2021, ending the year at an average of 2.96%.

However, a combination of supply chain disruption, generous stimulus packages, and pent-up demand have spurred inflation. In an effort to quell inflation, the Federal Reserve’s combative monetary policy—in addition to the forces of supply and demand in the housing and bond markets—have seen mortgage rates jump in 2022. For instance, the Fed increased rates by 25 basis points in March, 50 basis points in May, and 75 basis points in June—which helped push mortgage rates to where we are today at above 6%.

In summary, while rates are noticeably higher in 2022 than they were just several years ago, they still pale in comparison to the spikes seen between the ‘70s and ‘90s.

And though the Fed plans to make a few more hikes this year, which may put indirect pressure on mortgage rates, we’re very unlikely to revisit those extremes anytime soon. While rates may rise by another one or two percentage points, there are signs that the housing market is normalizing.

Home values are now appreciating at a slower rate, and demand is waning in light of high borrowing costs. These are welcome signs for borrowers and may signal that the bulk of the surge in rates is over, at least for now.

Where do mortgage rates go from here?

The consensus opinion is straightforward: We expect mortgage rates to continue climbing for the rest of 2022. But the big question remains: How far will rates rise? More specifically, are we likely to see the same trend persist through 2023 or even 2024?

Luckily for borrowers, the answer appears to be no. Economists and other experts predict that the 30-year fixed-rate mortgage will average between 5% and 7% by the end of 2022, and hold more or less steady from there. This is likely because the mortgage and bond markets have already digested inflation expectations and taken into account the bulk of both current and forecasted changes to the federal funds rate.

The National Association of Realtors, on the other hand, forecasts the 30-year fixed-rate mortgage to average between 5% and 5.5% throughout 2023, while the Mortgage Bankers Association’s June forecast predicts the rates will decline gradually to 4.4% in 2024.

Simply put, unless the Federal Reserve’s current plans to fight inflation fail, rates are unlikely to cross the double-digit threshold, much less top the rates seen in the ‘70s and ‘80s. Let’s go over a few factors that affect mortgage rates and take a look at how each of them are working to curb further increases.

The Federal Reserve and monetary policy

The Federal Reserve doesn’t set mortgage rates (or the interest rates of any debt instruments with lengthy maturities) directly. Instead, it sets monetary policy with the aim of promoting price stability and low unemployment.

It also controls the federal funds rate—a short-term interest rate that banks and other depository institutions charge each other to borrow funds overnight. However, the federal funds rate has some effect on long-term bonds, so mortgage rates usually rise in tandem with the federal funds rate. Because the Fed is likely to lower rates within the next 12 to 24 months if its current plans and aggressive rate hikes succeed in containing inflation, mortgage rates may decline as well.

What can investors do?

As a real estate investor, rising rates aren’t ideal. It means purchasing investment properties is more expensive now than it used to be. However, this doesn’t equal the end of the road, and there are actions you can take to insulate yourself from the impact of rising rates. Here are a few pointers.

Borrow now, refinance later

Remember that you’re not locked into your current rate forever. Even if you borrow now, you can always refinance your mortgage when rates decline in the future.

When you refinance, you may be able to reduce your overall interest payments, lower your monthly payments, and improve your monthly cash flows. Also, if your original mortgage is an adjustable-rate mortgage, you can refinance to a fixed-rate mortgage down the line to lock in a lower interest rate.

On the flip side, refinancing comes with closing costs and other fees that may nullify the benefit of long-term savings. And like any other loan application process, it’s a lengthy process that involves a significant amount of time and paperwork.

Lengthening the amortization period

The amortization period is the period of time you have before your loan is paid off, after which point you own the property outright. A shorter amortization period (like 15 years) means higher monthly payments but a lower overall interest burden, since you’ll be paying off more of the principal balance each month.

On the other hand, a longer amortization period (like 30 years) entails smaller monthly payments, which may make your loan more affordable and allow you to keep more of your monthly earnings. However, bear in mind that a longer amortization period also means that you’ll have to pay more interest over the life of your loan.

Increasing your down payment

If you have the cash, one of the best ways to manage rising mortgage rates is to make a larger down payment. A higher down payment means a lower loan-to-value ratio (LTV). This reduces the riskiness of the loan to the lender, which translates to lower interest rates and fees. Plus, contributing a higher down payment also means that you’ll be taking out a smaller loan, which will reduce your total interest burden.